WilliamsMarston Clears the Way for a Foreign Entity Acquisition

Learn how WM assisted a $250 million public company in acquiring a foreign entity, necessitating the first-time audit of five separate entities under U.S. GAAP.

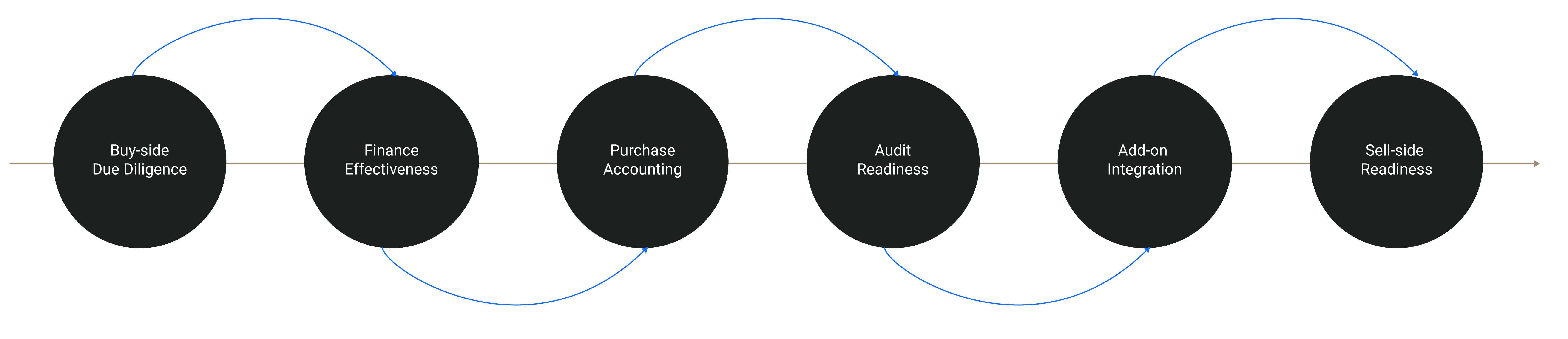

Read the Case StudyWhen it comes to M&A, buyers and sellers face deep complexity. Our professionals apply their knowledge and expertise to the entire transaction lifecycle to minimize disruption and help you meet critical deadlines.

On the buy side, we can assist with financial due diligence, purchase accounting, post-merger integration and SEC reporting. On the sell side, we help companies prepare for diligence, positioning them for the most successful exit possible. Count on WM to see you through.

WM has the expert research, financial and strategic capabilities that support each step of your transaction.

Whether you’re looking to unlock value via a carve-out or spin-off, or sell an asset that is no longer aligned with your organization’s strategic roadmap, WM can help you divest assets and operations to generate cash, improve operating performance and refocus on your core business. No matter the economic conditions, industry dynamics or regulatory environment, our professionals can accelerate the process to drive the success of your business.

WM provides a number of services to streamline and accelerate the divestiture process.

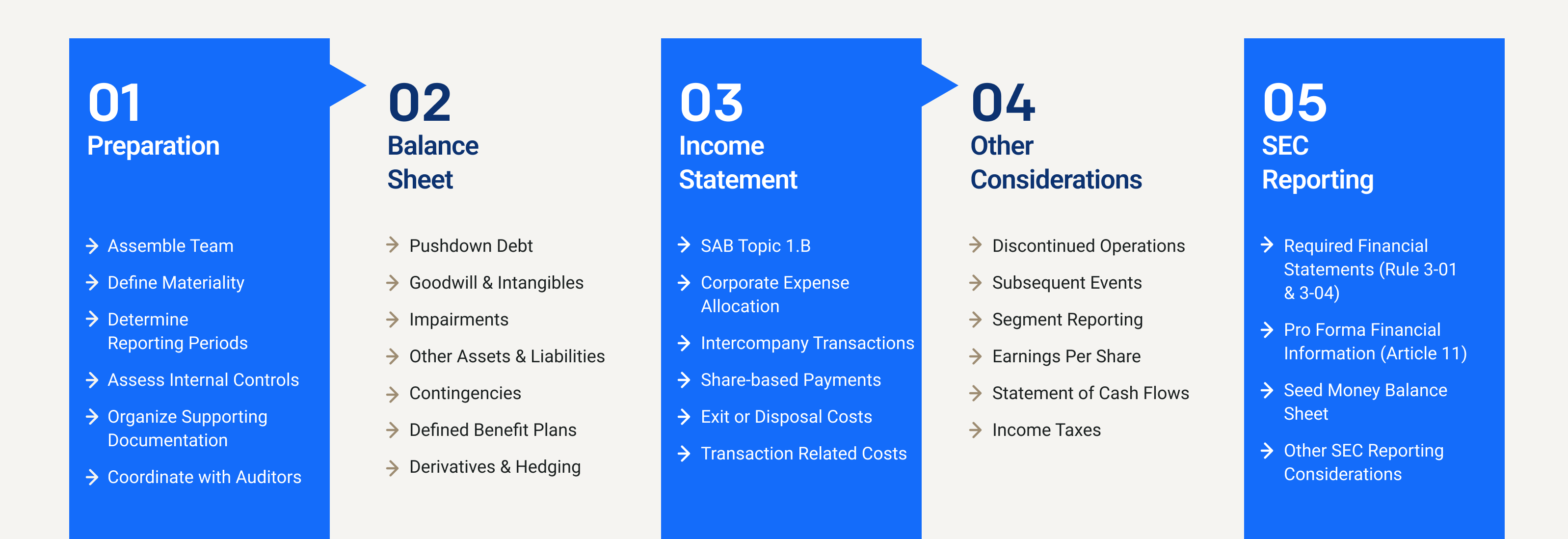

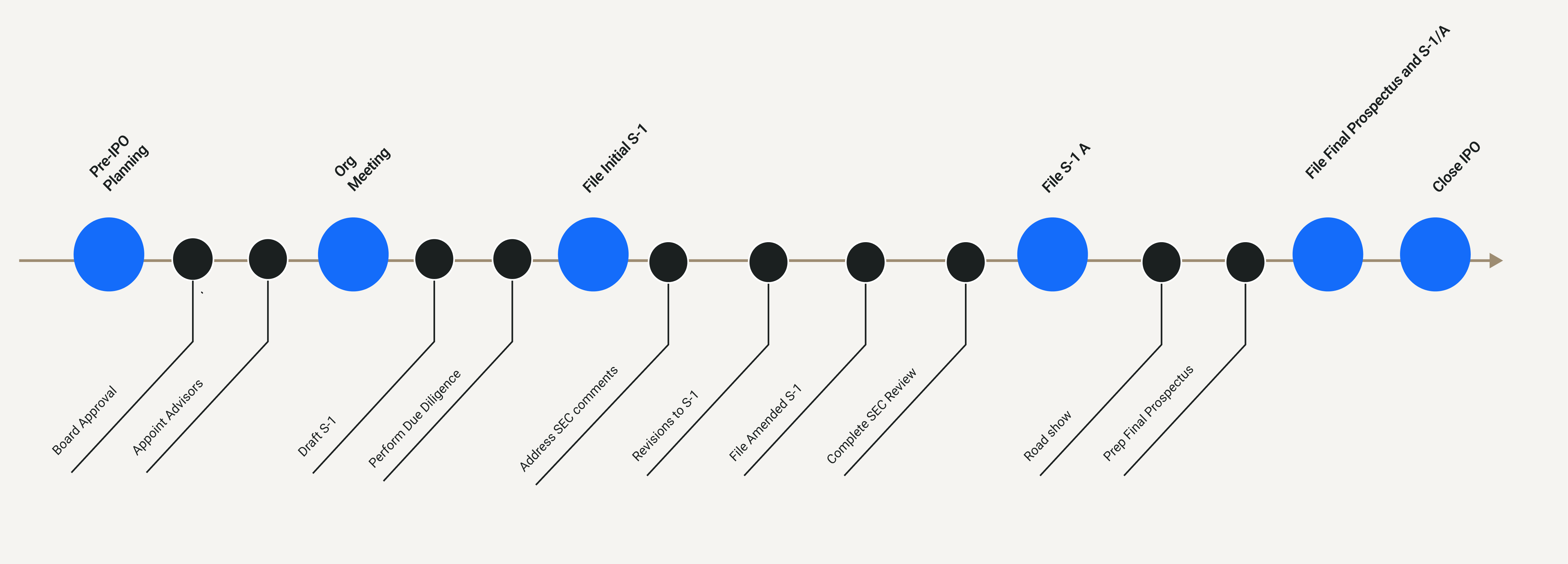

Avoid surprises and delays in the IPO process with WM. Clients across various industries and states of readiness have seen their way through to successful IPOs with WM by their side, working closely with auditors, attorneys and investment bankers throughout the entire process.

From assessing IPO readiness to providing hands-on assistance with preparing historical, pro forma and selected financial data, WM will ensure you move forward in full compliance with SEC requirements to successfully take your company public.

WM will help prepare you for an external audit and advise your leadership team on the SEC reporting process to ensure a successful offering.

WilliamsMarston is here to help you fill skill and leadership gaps, navigate uncertainty and seamlessly manage unexpected turnover. Our interim management services provide you with access to highly qualified, dedicated professionals with both technical proficiency and operational experience to take on a range of mission-critical roles across the C-Suite, Director and Managerial level leadership.

We can quickly deploy professionals onsite to work alongside you and your team. Our interim management engagements typically range from three to six months in duration. WM has the scale and flexibility to provide you with the capabilities and continuity needed to move your business forward without interruption.

WM will efficiently bridge your company’s skill and leadership gaps, providing highly qualified professionals for critical roles and ensuring seamless operations during key business periods.

At WM, we excel at taking on the complex technical accounting challenges our clients face, allowing management to manage. Our professionals routinely assist our clients with researching, analyzing, documenting and implementing the accounting for the most complex transactions and standards.

Count on WM’s experience in a variety of complex areas. We keep current with the latest accounting standards and proactively evaluate the accounting for unique transactions – allowing you and your teams to focus on day-to-day operations.

WM can support you with a variety of technical accounting services for complex transactions and operational efficiency.

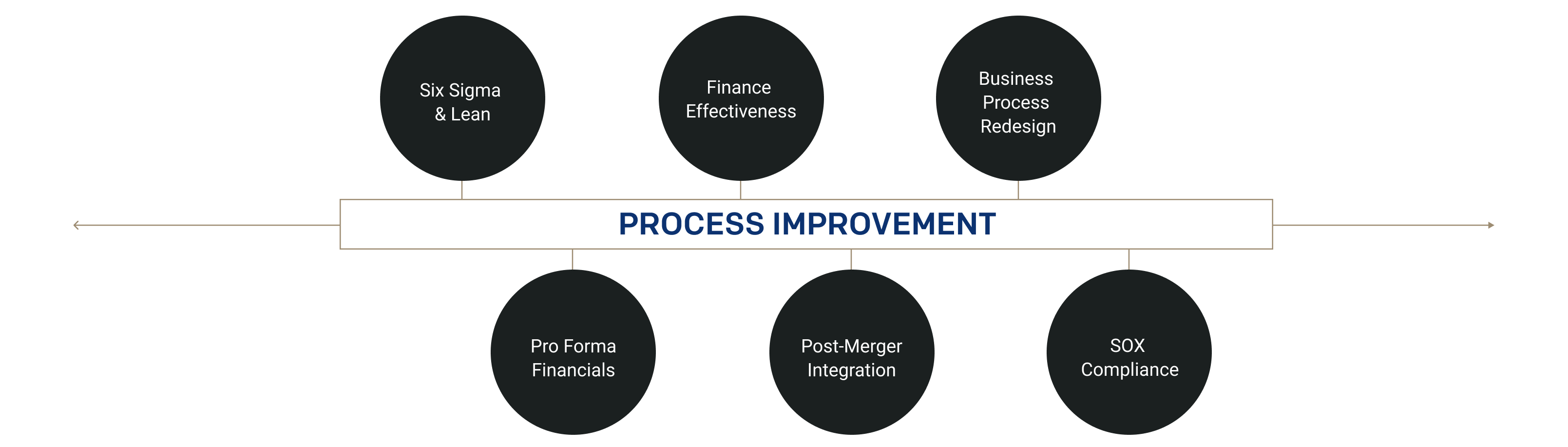

WM’s finance effectiveness experts bring a pragmatic and operational perspective to process improvement and internal controls. With expertise and a relentless dedication to quality and consistency, we identify and resolve challenges before they impact the broader business.

We specialize in solving the most pressing and complex problems with finance effectiveness services that touch multiple aspects of your organization. Our proven approach delivers a rigorous assessment and design of processes and internal controls. As a result, our clients leverage our work to eliminate inefficiency and redundancy while lowering costs and mitigating risks.

Our proven experts enable you to streamline your financial processes, eliminating redundancy and achieving lasting results and efficiencies.

Financial planning and analysis (FP&A) is one of the most critical finance functions – yet many organizations lack the resources to do it effectively. WM experts can help you understand your current operations from multiple angles and chart a path to scalable, long-term growth and profitability.

At WM, our cross-functional team of experts consists of former controllers, FP&A specialists and consultants with a deep understanding of financial strategy, forecasting, planning, analytics, key performance indicators (KPIs), financial reporting and other finance-related matters. With the right combination of people, processes and technologies, we’ll help you streamline and deliver a finance capability that propels your organization to exceed its goals.

Learn how WM assisted a $250 million public company in acquiring a foreign entity, necessitating the first-time audit of five separate entities under U.S. GAAP.

Read the Case StudyReady for clear guidance and powerful outcomes? Reach out to our Accounting Advisory Services team today.

Meet the Team

Landen C. Williams

Managing Partner

Managing Partner

Landen brings over 20 years of consulting and executive management experience to WilliamsMarston. Prior to WilliamsMarston, he was a Managing Director in the Accounting Advisory Services practice at KPMG LLP where he advised Fortune 100 companies on the accounting and reporting for mergers, acquisitions, divestitures, restatements, revenue recognition and other complex transactions. He was also one of the firm’s leaders on the new revenue recognition standard; frequently speaking to clients and industry groups on the new standard.

Prior to KPMG, Landen was a Managing Director in the Financial Restructuring practice of FTI Consulting, Inc. where he advised distressed companies on restructuring strategies, liquidity and cash management, and cash flow modeling. Landen started his career in the Audit and Advisory practices of PricewaterhouseCoopers LLP where he rose to the level of Manager. While at PricewaterhouseCoopers LLP, his clients included large SEC registrants in the technology, software and life sciences industries.

Throughout his career, Landen has advised senior management and board members of private and public companies on the accounting and reporting for complex transactions and restructuring. His broad industry experience includes biotechnology, pharmaceuticals, software, technology, telecommunications, manufacturing and financial services. Landen is a Chartered Financial Analyst (CFA) and holds a Bachelor of Science in Business Administration degree from Boston College with concentrations in accounting and finance.

Jonathan T. Marston

Managing Partner

Managing Partner

Jon brings over 20 years of accounting, tax, valuation advisory and executive management experience to WilliamsMarston. Jon’s primary practice areas include mergers and acquisitions, technical accounting and process improvement. He has also served in various interim capacities at the CFO, Director of Corporate Development and Corporate Controller level. His clients include several large private equity firms, private equity-backed companies, and public companies with revenues ranging from $200M to $10B.

Prior to WilliamsMarston, Jon was a Director in PricewaterhouseCoopers LLP’s Transaction Services Advisory practice. While at PwC, Jon provided due diligence, technical accounting, and financial and strategic advice to clients in connection with mergers and acquisitions ranging from $5M to over $20B.

Throughout his career, Jon has advised SEC registrants, foreign public companies, private companies, private equity and VC firms. He has advised management and investors on issues pertaining to US GAAP, IFRS, SEC reporting, financial and operational performance, quality of earnings, revenue recognition, stock-based compensation, initial public offerings, and Sarbanes-Oxley compliance. Jon has significant experience with acquisitions, divestitures, carve-outs, purchase agreements and purchase price adjustment mechanisms. His broad industry experience includes software, technology, telecommunications, health industries, industrial products and consumer retail sectors in the US, Europe, Africa and Asia.

Jon holds a Bachelor of Science in Business Administration degree from Boston College with a concentration in Accounting.

Travis Hannon

Partner – Southeast Region Advisory Leader

Partner – Southeast Region Advisory Leader

Travis has spent 22 years working with private-equity backed companies across a wide spectrum of industries including manufacturing, healthcare, software and services businesses. His expertise involves consistently delivering positive accounting advisory outcomes to clients in the ripples of transaction-related change events, including acquisitions, divestitures, carve-outs and capital market transactions. Travis’ clients and their equity sponsors benefit from his depth of technical accounting expertise combined with a pragmatic, outcome-focused, approach to client service.

Prior to joining WilliamsMarston, Travis was a partner and co-founder of Paradigm Advisory, LLC where he helped build and lead Paradigm’s private equity advisory practice. Travis began his career in PricewaterhouseCoopers LLP’s Private Company Services practice, where he worked with a wide variety of private-equity backed companies.

Travis holds a B.A. in Accounting from The University of Georgia and is a Certified Public Accountant in Georgia.