Summary/Key Takeaways

- The IPO market shows signs of recovery after a quiet 2023 and historic low in 2022.

- Consider the pros and cons of operating as a public company to ensure the benefits outweigh the burdens.

- Early preparation and assembling the right team are crucial to success.

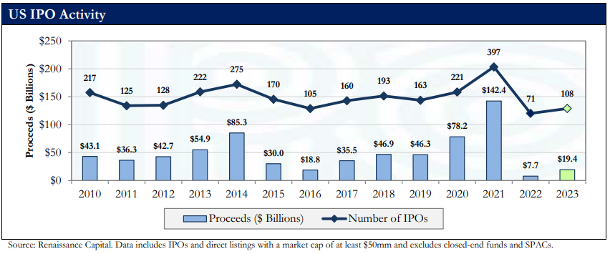

Amid an emergence from a global pandemic, 2022 was marked by a historically low level of initial public offerings (IPO), and despite signs of recovery, the lull continued in 2023 due to economic headwinds and geopolitical pressures. IPO market activity in 2023 in the U.S. signaled the start of a revival with 108 IPOs that raised a combined $19.4 billion, a noticeable increase from 2022. Consistent with historical norms, small issuers continued to represent the majority of the activity and produced modest returns compared to larger IPOs.

The SPAC market also experienced far fewer successful listings in 2023, with only 31 “blank check” companies going public and de-SPAC activity producing just under 100 companies listing via SPAC merger, a slight decrease from 2022. With the latest SEC rules eliminating what many viewed as a key benefit of de-SPAC transactions, companies seeking access to the public equity markets are expected to revert to traditional IPOs.

As the list of companies waiting to access the capital markets grows and investor confidence rises, all signs point to an IPO market recovery. Diligent preparation is necessary to ensure a company looking to IPO is ready for the capital markets—understanding exit activity, valuation trends, deal size, and activity within relevant sectors, among many other factors. Companies who diligently prepare are more likely to create value and maximize the benefits of an offering.

Weigh the Public Company Pros and Cons

Weighing the pros and cons of going public requires companies to have critical conversations about where they are headed, their goals and what timing could look like. There are many factors to consider, including the following:

| Pros | Cons |

|

|

Careful consideration should be given to the possible benefits of being a public company as well as the potential obstacles that may follow an IPO. Throughout the preparation phase of an IPO, these factors will become apparent and could change a company’s trajectory when accessing the capital markets.

Consider Your Organization’s Current Position

Companies who look to IPO will experience a myriad of necessary changes to their organization, especially their people and the day-to-day focus of their decision-makers. When executed properly, these changes can result in a company’s heightened level of preparedness to endure not only the IPO journey (typically 12 to 18 months) but during its time as a public company. One of the most critical steps to get right is honing the company’s equity story, which needs to be supported through measured results and reliable financial reporting appropriate for external auditors and public market scrutiny.

To be an attractive IPO candidate, the market looks for key attributes such as:

- Holding a leading market position with respect to competitors

- Preparing and articulating a compelling investment thesis

- The ability to confidently forecast and support revenue growth and profitability

- Having a proven management team and a sound corporate governance framework

As a company begins their IPO journey, the first step is to perform an IPO readiness assessment designed to identify gaps and areas to consider improving. This assessment will help facilitate a fresh look at the organization, its processes, risks and controls, and policies and procedures to allow for informed decisions concerning any required prework or assistance needed. This assessment can take substantial time and effort, with each company’s overall timeline unique.

Ready Your Organization — Factors that Drive Success

There are many success factors to be assessed in determining a company’s overall readiness for an IPO. Companies should be proactive in their preparations, perform in-depth research, and remain open to all options as they approach the process.

Prepare to be a public company and prepare early

- Ensure a plan is established to allow for 12 to 18 months of time necessary for transformations to the organization to be implemented and to take hold.

- Engage both internal and external resources. The effort associated with the IPO journey will be more than anticipated.

- Ensure key employees are engaged and incentivized to act like a public company long before the IPO.

- Understand KPIs relevant to your business and ensure that information is readily and repeatedly available.

Engage with Investors

- Understand investor expectations early in the process as the equity story is being honed.

- Ensure that the proper governance changes are made so that investors know that a strong leadership team oversees their investment.

- Stay current with regulatory matters such as ESG to limit the potential for surprises.

Evaluate Options Available to Access the Capital Markets

- Ensure the organization’s equity story is told accurately and compellingly and explore all options for an exit event or potential funding alternatives.

- Consider a dual path, such as an IPO and a sale to a strategic buyer, to ensure capital is raised in the most efficient manner.

- Flexibility with respect to optionality will be a strategic advantage if and when the financial markets challenge an IPO effort.

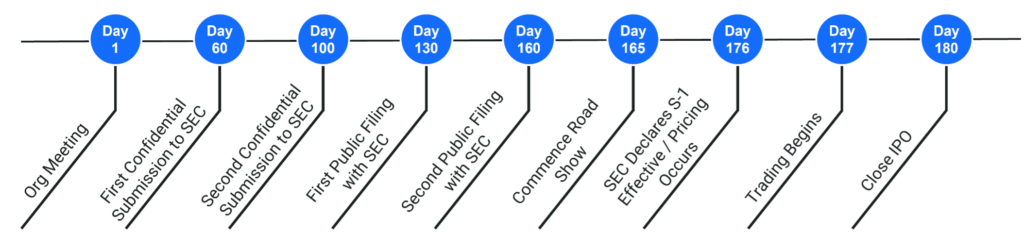

Once your company feels prepared for going public, typically, the six months leading up to the actual IPO follows a similar journey for most organizations.

Fully understanding and being able to concisely articulate a company’s position relative to an IPO well before the close is crucial to driving successful outcomes. The IPO readiness assessment will facilitate this heightened level of preparedness before the final push.

Assemble the Right Team – WilliamsMarston IPO Readiness Assessment

Ensuring you have an expert team is critical to success. In addition to the internal team within the organization who will be critical to the process, building the right external team is also pivotal. This will include the selection of bankers, lawyers, auditors, investor relations and advisors. Being prepared means transforming many aspects of the business, the organization’s culture and key players’ roles and responsibilities. The combined team will need to be prepared and ultimately held accountable for increased filing requirements, heightened transparency, compliance with various rules and regulations, and scrutiny by regulators, investors and analysts.

The WilliamsMarston IPO Readiness Assessment is a structured diagnostic analysis intended to accomplish the following:

- Identify readiness gaps surrounding enhancements to personnel, governance matters, technical accounting items, as well as processes and related controls.

- Detail the regulatory requirements on a go-forward basis and identify the training and personnel enhancements necessary so the team will be prepared to meet the challenges ahead.

- Prioritize the gaps identified in the diagnostic phase and prepare a roadmap to address the necessary improvements.

Thoughtfully performing this readiness assessment typically yields various workstreams requiring the entire team to react accordingly. These efforts will bear fruit in the form of being prepared as the SEC reviews a company’s registration statement on Form S-1, which includes the necessary audited financial statements. The diagnostic assessment will flush out a variety of issues, including those that the SEC routinely challenges.

WilliamsMarston has a proven track record of successfully advising clients through the pre- and post-IPO steps, offering valuable insight and transparency—with a keen ability to anticipate expectations of stakeholders, regulators, sponsors, and investors. Our team of experts can help management identify and plan for organizational changes through strategic planning. Whether an IPO is ultimately successful depends on many factors, including crafting the right story, ensuring the timing of critical milestones is properly planned and executed, and monitoring the capital markets, as pricing will be a gating decision.